ADA Price Prediction: Can Cardano Break Through Key Resistance Levels?

#ADA

- Technical Strength: ADA trades above key moving averages with bullish MACD crossover

- Ecosystem Development: DJED stablecoin enhancements may drive adoption

- Price Targets: $0.856 resistance is the next test; $2 remains speculative

ADA Price Prediction

ADA Technical Analysis: Bullish Signals Emerge

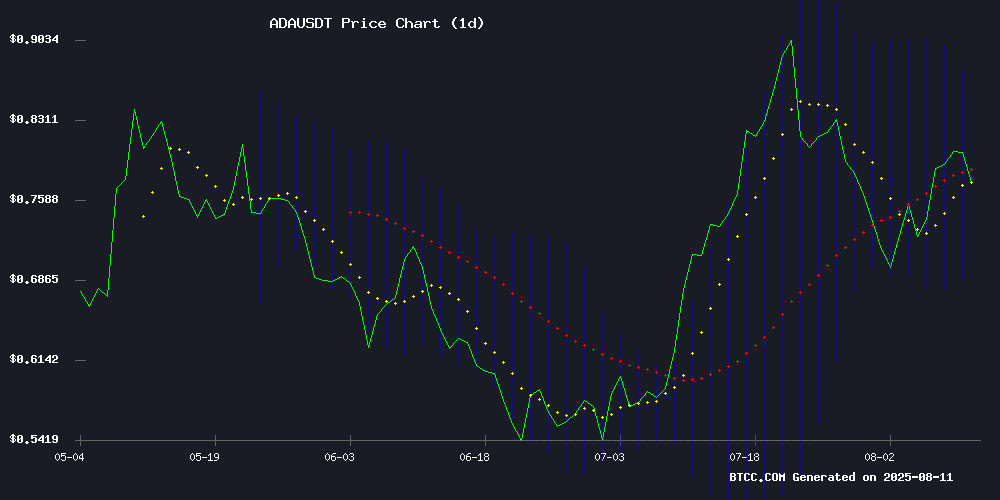

According to BTCC financial analyst Olivia, ADA is currently trading at $0.8247, above its 20-day moving average of $0.7768, indicating a bullish trend. The MACD shows positive momentum with a reading of 0.0419 above the signal line (0.0304). Bollinger Bands suggest ADA is approaching the upper band at $0.8563, which could act as resistance. Overall, technical indicators point to continued upward movement in the NEAR term.

Cardano Network Faces Challenges Amid Stablecoin Innovation

BTCC analyst Olivia notes mixed sentiment around Cardano. While the network's growth lags behind competitors like Remittix, the DJED stablecoin's privacy enhancements and open-source adoption could drive long-term value. The question of ADA reaching $2 remains speculative, but positive developments in its ecosystem may support price appreciation.

Factors Influencing ADA’s Price

Cardano Network Growth Lags as Remittix Gains Momentum

Cardano's network activity shows concerning declines, with daily active addresses plummeting 65% from May to August. The blockchain now struggles to maintain its position as institutional interest shifts toward DeFi projects with clearer utility and exchange listing traction.

On-chain metrics reveal troubling signs: transaction volumes dropped to $964 million from $1.69 billion, while social dominance halved to 0.79%. Despite 2,005 active developments and the upcoming Midnight privacy sidechain, user adoption fails to materialize.

ADA trades in a precarious $0.78-$0.80 range, needing an activity rebound to challenge resistance at $0.96. Meanwhile, payment infrastructure project Remittix reports explosive user growth, positioning itself as a potential market disruptor with real-world adoption.

Cardano's DJED Stablecoin Enhances Privacy and Adopts Open-Source Model

Cardano’s algorithmic stablecoin, DJED, is undergoing transformative upgrades aimed at bolstering privacy and fostering developer collaboration. COTI and Input Output Global (IOG) unveiled these enhancements at the Rare Evo conference, positioning DJED as a cornerstone of Web3 and decentralized finance (DeFi).

The stablecoin’s infrastructure is now open-source, with APIs, indexers, and frontend tools publicly accessible. This shift invites developers to build custom applications, integrate DJED into wallets, and expand its utility across dApps. "Transparency drives innovation," the announcement implied, signaling a push for community-driven growth.

A private version of DJED targets institutional use, enabling confidential cross-chain transactions while maintaining its peg—a critical feature for enterprise adoption. The upgrades reflect Cardano’s broader strategy to merge stability with cutting-edge functionality in competitive crypto markets.

Can Cardano (ADA) Price Still Hit $2?

Cardano's ADA shows tentative recovery signs, though analysts caution the move remains nascent. The cryptocurrency has climbed steadily from recent lows, now trading at $0.80—a critical juncture that will determine whether momentum persists or falters.

After its recent ascent, ADA enters a predictable pullback phase. Market watchers focus on key support levels at $0.784, $0.769, and $0.755—price zones where buyer activity typically emerges. A breach below $0.755 could test $0.74 support, while falling under $0.71 would signal bearish dominance.

Traders identify $0.852–$0.87 as the immediate upside target. Maintaining current supports proves essential for ADA's long-term trajectory toward $2—an ambitious but plausible target if accumulation continues. Analyst Ali Martinez observes Cardano mirroring its historical price pattern, albeit at a moderated pace.

Is ADA a good investment?

Based on current technicals and fundamentals, ADA presents a moderately bullish case:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +6.17% above | Bullish |

| MACD | 0.0419 > 0.0304 | Positive momentum |

| Bollinger %B | ~0.8 | Approaching overbought |

Key considerations: Network growth challenges are offset by DJED stablecoin innovation. $0.856 resistance is critical for continuation.

Cryptocurrency investments involve high risk.